The City of Santa Monica’s Measure GS and L.A. City’s Measure ULA go into effect on March 1, 2023, and April 1, 2023.

With the increase in the City Transfer Tax for these areas, reduce the number of properties listed for sale. Time will tell; however, my guess is the surrounding communities not within the City of Los Angeles, and Santa Monica will now have more opportunity with the reduction of inventory in these high-end properties.

Santa Monica Measure GS

Santa Monica Measure GS will go into effect on March 1, 2023.

This measure adds a third-tier tax rate on sales of properties over 8 million dollars in the City of Santa Monica for schools, homelessness prevention, and affordable housing.

Prior to March 1, 2023, there are only two tax tiers in the City of Santa Monica:

– Tier one- $3.00 (per $1,000.00) on sale amounts of $4,999,999 or less.

– Tier two- $6.00 (per $1,000.00) on sale amounts of $5,000,000.00 and above.

Subsequent to March 1, 2023, there will be three tiers and they will be as follows:

– Tier one- $3.00 (per $1,000.00) on amounts of $4,999,999 or less

– Tier two- $6.00 (per $1,000.00) on amounts of $5,000,000 thru $7,999,999.00

– Tier three- $56.00 (per $1,000.00) on amounts $8,000,000.00 and above.

Los Angeles (City) Measure ULA

Los Angeles Measure ULA will go into effect on April 1, 2023.

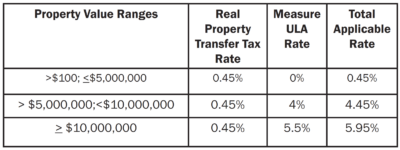

This measure adds an additional transfer tax for the sale of properties in the City of Los Angeles, on top of the City’s existing real property transfer tax rate of 0.45%, for sales of over $5,000,000.00 and $10,000,000.00, for establishing programs to increase affordable housing and to provide resources to tenants at risk of homelessness.

1. Prior to April 1, 2023 properties sold in the City of Los Angeles are charged a Real Property Transfer Tax of 0.45%.

2. Subsequent to April 1, 2023 properties sold in the City of Los Angeles for less than $5,000,000.00 will be charged a Real Property Transfer Tax of 0.45%.

3. Subsequent to April 1, 2023 properties sold in the City of Los Angeles at $5,000,000.00 thru $9,999,999.99

will be charged a Real Property Transfer tax of 4.45%.

4. Subsequent to April 1, 2023 properties sold in the City of Los Angeles at $10,000,000.00 and above will be

charged a Real Property Transfer Tax of 5.95%

In summation, after April 1, 2023, the rates for the City of Los Angeles can be applied as follows:

Property Value Ranges Real Property Transfer Tax Rate Measure ULA Rate Total Applicable Rate.

A quick example:

Sale Price 6,000,000.00

City Transfer Tax Prior to April 1, 2023: $27,000.00

City Transfer Tax Currently under Measure ULA: $240,000.00

Not sure if you ae in the City of LA?

Communities within LA City.

Measure ULA applies to properties within the City of Los Angeles, but it does not apply to the 87 incorporated cities within LA, such as Beverly Hills, Culver City, West Hollywood, Pasadena, and Long Beach.

This video is advice on the best practices to verify your closing cost. The numbers quoted do not include the calculations for the above new tax tiers.